Supply Chain Pressure

Farmers sit much further ‘upstream’ in the supply chain and as such are vulnerable to supermarket monopolies. Supermarkets have moved towards a model which favours direct contracts with farmers and are in a position to impose their own terms1Retailer-driven agricultural restructuring—Australia, the UK and Norway in comparison,Richards, Carol ; Bjørkhaug, Hilde ; Lawrence, Geoffrey ; Hickman, Emmy, Agriculture and human values, 2013-06, Vol.30 (2), p.235-245 (also see Figure 2).

Ex-prime minister, Tony Blair, once described supermarkets as having an “armlock” over farmers.2Freidberg, S. (2004). The Ethical Complex of Corporate Food Power. Environment and Planning D: Society and Space, 22(4), pg 521

This report has already mentioned how the big supermarkets have managed to transfer regulatory controls to farmers and suppliers further up the food chain. While supermarkets must comply with government regulation set out by the Food Standards Agency, the retailers also impose their own private standards.

A lack of harmonisation has had a negative impact on farmers and has squeezed out small-scale operators who cannot afford the additional burden of third-party auditing costs and investment in specialised equipment and technology.3Retailer-driven agricultural restructuring—Australia, the UK and Norway in comparison,Richards, Carol ; Bjørkhaug, Hilde ; Lawrence, Geoffrey ; Hickman, Emmy, Agriculture and human values, 2013-06, Vol.30 (2), p.235-245

Private regulation has seen a structural shift in the agricultural sector where small-scale farms are faced with a choice of ‘go big or get out’. Interviews with a range of stakeholders in the farming industry from 2012 found that farmers’ biggest concern was what they described as a ‘cartel-like’ buying power pushing prices below production costs.4ibid

Given the industrialised and global nature of our modern food system, many small-scale farmers have left the industry as they are not in a position to negotiate better prices from other actors along the supply chain, especially when there are fewer and fewer actors to turn to.

From seed to supermarket, the food system is under increasing pressure and consolidation in the hands of a few giant agribusiness corporations. The stranglehold these companies have on the farming and food sectors has seen prices plummet for crops and food animals, the risk of food safety issues heighten and the resilience of the food system weaken, as producers and supermarkets compete in a race to the bottom to provide consumers with the cheapest products while maximising profits. Firms such as Cargill and JBS aim to control every link in the food chain, from farm inputs (feed, etc) and food manufacturing, to distribution and grocery retail.

Much of today’s consolidated UK food industry is a result of decades of mergers, acquisitions and takeovers. Just last year, Italian food giant Newlat Food bought Hovis, and PepsiCo acquired a 9% stake in plant-based snack company Rude Health.5https://www.foodmanufacture.co.uk/Article/2020/10/14/Food-industry-mergers-acquisitions-and-overseas-investments-plunge?utm_source=copyright&utm_medium=OnSite&utm_campaign=copyright

On a global scale, mergers along a supply chain form large corporations that each use their economic leverage to drive down costs and erode competition in the food system. As the range of choices open to a farmer is diminished, more avenues open to the agri-giants.6Stuffed and Starved: The Hidden Battle for the World Food System

Health and Safety Concerns

Nothing conjures up the public’s fear in the era of the ‘new normal’ as the thought of another disease outbreak. Unfortunately, today’s food system is inherently set up to do just that!

Concentration in the agriculture sector is responsible for a reduction in quality and safety.13Woodall, P., & Shannon, T. (2018). Monopoly Power Corrodes Choice and Resiliency in the Food System. The Antitrust Bulletin, 63(2), 198-221. pg 199 A globalised, complex system leaves the chain of production vulnerable to weaknesses. If one point in the system fails, it can leave the entire food chain open to problems of food safety and disease.

Nowhere was that more evident than in the 2013 horsemeat scandal. With only a few food and retail companies relying on a global network of brokers, cold store operators and subcontracted meat cutting plants to deliver the products ‘just-in-time’, it was inevitable that a contamination problem somewhere in the chain would eventually occur.

While supermarkets and retailers have been slashing prices and offering discounted products to customers, the price of producing that meat (energy, fuel, feed…) has gone up. The search for rock-bottom prices led to outsourcing beyond the purview of the retailers and a lack of regulatory controls.

We will later see how consolidation of the food chain by the retail giants has significantly reduced the number of local abattoirs. Today, animals can be transported across the entire country just to be killed. It was this long distance travel and chokepoints at the few, large abattoirs still in operation that caused the 2001 foot and mouth outbreak in the UK. Mass transit of cattle over long distances is very rarely looked at as a cause of Bovine TB when evidence suggests it is the likely cause and not the fault of the much maligned badgers.

Despite the industries claims of full traceability, complex systems and the search for continued cost cutting opportunities by the large food corporations means health and safety scandals are more likely to happen in the future.14https://www.theguardian.com/uk/2013/feb/15/horsemeat-scandal-the-essential-guide#104

A single problem in one large processing plant can impact the entire UK food supply. Outbreaks of Covid-19 required a significant percentage of meat-packing staff to take time off to quarantine in 2021 and prompted the British Meat Processors Association (BMPA) to warn of a risk to meat supply.

Having fewer, but much larger, processing plants raises the risk of supply chains failing if one has to be temporarily shut down. This scenario happened in 2020 when the 2 Sisters’ Anglesey plant was closed following a Covid outbreak.15https://www.foodmanufacture.co.uk/Article/2020/06/17/Coronavirus-cluster-at-2-Sisters-plant In July 2021, the owner of 2 Sisters, Ranjit Singh Boparan, said the industry was at “crisis point” due to the pandemic and Brexit.16https://metro.co.uk/2021/07/23/uk-facing-worst-food-shortages-since-the-war-due-to-covid-and-brexit-14976469/

For an indication of what might happen, we have only to look at the USA where the food industry is even more heavily consolidated. In 2011, Cargill recalled more than 36 million pounds of ground turkey meat infected with antibiotic-resistant salmonella after 136 people across 34 states fell ill, were hospitalised or died.17Woodall, P., & Shannon, T. (2018). Monopoly Power Corrodes Choice and Resiliency in the Food System. The Antitrust Bulletin, 63(2), 198-221. pg 200

2021 saw a salmonella outbreak linked to Polish chicken from one supplier which sold to Sainsbury’s, Morrisons, Lidl, Aldi and Iceland. 480 cases have been reported so far, with at least one person dying from the infection.18https://www.theguardian.com/society/2021/feb/22/deadly-salmonella-outbreak-in-uk-linked-to-chicken-products

Domination of the Retail Sector

The consolidation of the food and farming industries is directly at odds with growing consumer awareness around how food is produced. Demand for transparency and traceability from farm to fork is driven by the public’s concern for the environment and climate change, health and nutrition, animal welfare, food waste, economic fairness and foreign imports.25https://projectblue.blob.core.windows.net/media/Default/Consumer%20and%20Retail%20Insight%20Images/PDF%20articles/TrustInFarming_210121_WEB.pdf

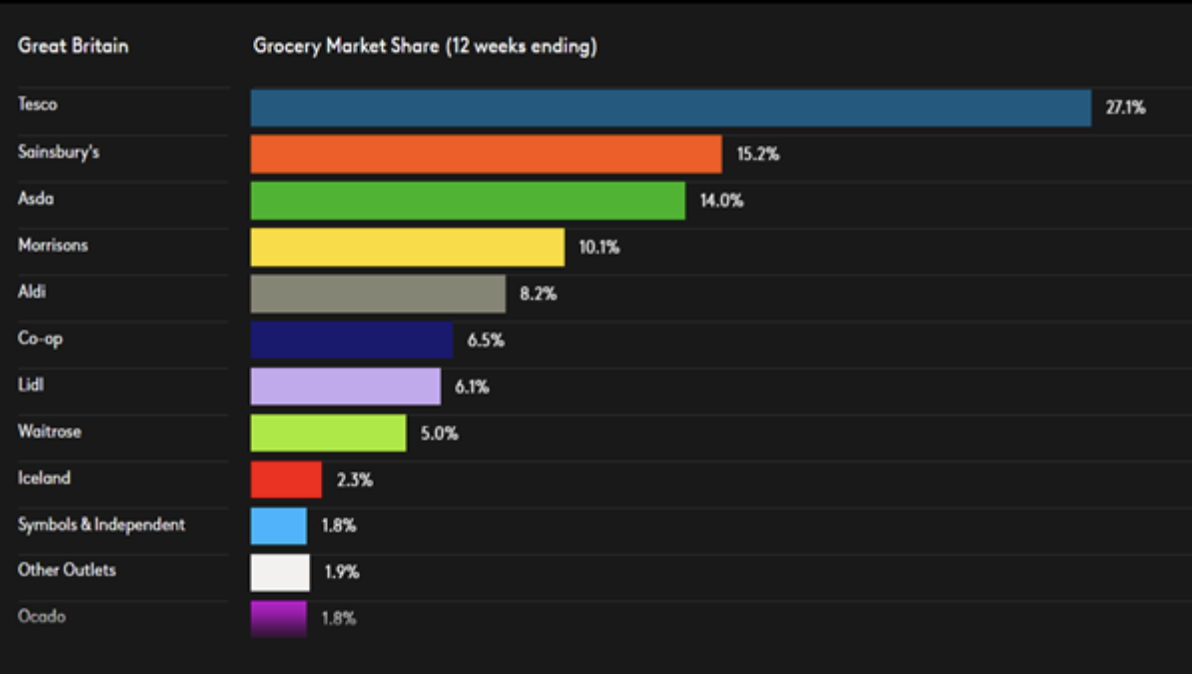

Given that 98.2 per cent of the UK grocery market is controlled by supermarkets – with 66.4 per cent attributed to the top four (Tesco, Sainsbury’s, Asda and Morrisons) – access to locally grown, organic, sustainable and equitable food direct from the supplier is virtually impossible for some. On the other hand, it is increasingly difficult for small-scale suppliers to compete in a landscape which rewards large scale at low cost.

To add to this consumer confusion, large food corporations have been buying up organic or ethical brands to prevent a loss of sales. While hyper-processed products, rich in artificial ingredients have seen sales stagnate,26Kelsey Gee & Heather Haddon, Food Giants Set Their Sights on Organic, Natural Companies, Wall Street Journal, July 8, 2016: https://www.wsj.com/articles/food-giants-set-their-sights-on-organic-natural-companies-1467990819 organic food and drink in the UK has seen annual growth since 2011.

Corporations are looking to take a slice of this market share with an annual sales revenue of £2.3bn (2019).27https://www.statista.com/statistics/282379/organic-food-and-drink-sales-in-the-united-kingdom-uk-since-1999/ These large multinationals are reluctant to tell consumers about their ownership in order to maintain the products’ ‘independent’ image. Brands such as Green and Black’s, Innocent, Abel and Cole, Seeds of Change and Rachel’s Organic are owned by conglomerates such as Unilever, Kraft, Nestlé and PepsiCo.

However, labels and websites will often fail to mention the parent company. It is no surprise that in a 2011 Which? magazine survey, consumers only knew the ownership of around one in ten ethical brands.28https://conversation.which.co.uk/food-drink/find-out-who-really-owns-our-ethical-food-brands/

The same can also be said about the vegan food market. Meat-free products in the UK increased from £488m in 2019 to £577m in 2020 and the big industry players are keen to grab a stake in an industry which is set to be worth $35.4bn by 2027.29https://www.bbc.co.uk/news/business-54986315 Again, big companies are getting involved here – for instance, Unilever owning The Vegetarian Butcher.

While it may help the nascent protein alternative brand expand, the downsides could involve less choice for the consumer and no way to stop your money going to brands with unethical practices that profit from animal exploitation.